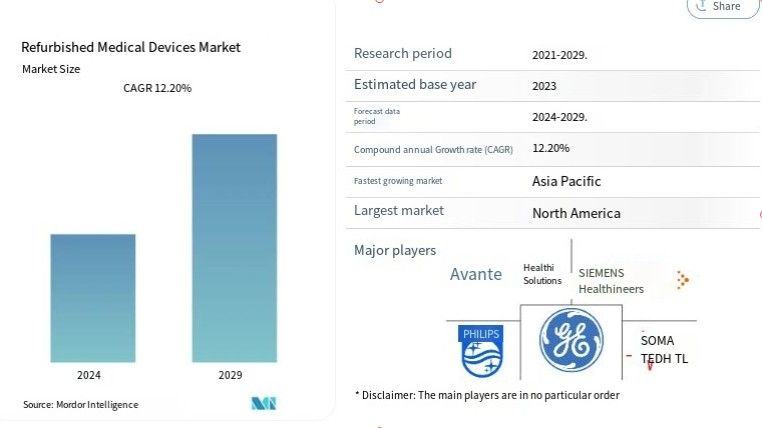

Market size of refurbished medical devices

Market analysis of refurbished medical devices

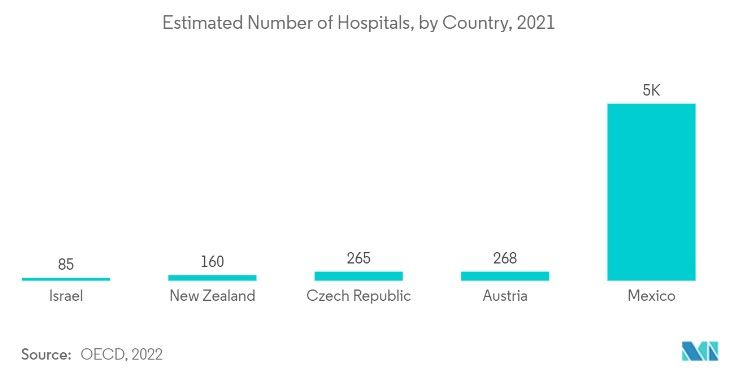

The refurbished medical device market will grow at a CAGR of 12.2% during the forecast period. During the COVID-19 pandemic, the demand for refurbished medical equipment such as mechanical ventilators and patient monitoring equipment has increased significantly to meet the needs of large numbers of patients. However, supply chain disruptions and trade bans have negatively impacted the refurbished medical device market. Factors such as cost control pressure in healthcare organizations, availability of refurbished medical devices, and increase in healthcare service providers are expected to drive the market growth. For example, according to data published by the American Hospital Association in 2022, there are approximately 6,093 hospitals in the United States. According to the same source, there are some 2,960, 1,228, 951, 207, 635 and 112 non-governmental non-governmental hospitals. For-profit community hospitals; Investor-owned (for-profit) community hospitals; State and local government community hospitals; Federal government hospitals; And non-federal psychiatric hospitals. In addition, according to Canada.ca, there will be about 1,265 hospitals in Canada by 2022. As a result, the large number of medical institutions is expected to increase the demand for refurbished medical equipment. Along with the demand for new equipment, the demand for refurbished medical equipment is also increasing around the world. More and more new hospitals are choosing alternatives to reduce capital investment. Some hospitals prefer to refurbish medical equipment to save on capital investment and provide care at an affordable cost to patients. In addition, the demand for refurbished medical equipment is much higher in low - and middle-income countries, one of the main reasons being underdeveloped health infrastructure and limited access to medical resources. Therefore, factors such as affordability and increasing number of medical service providers are expected to drive the market growth during the forecast period. However, quality issues of refurbished medical devices by end users and reluctance of healthcare providers to purchase refurbished medical devices are expected to hinder the market growth.

efurbished medical device market trendsR

Medical imaging devices are expected to hold a significant market share during the forecast period

Medical imaging refers to technology used to visualize the human body to diagnose, monitor, or treat medical conditions. Each technique provides specific information about a specific area of the body. Factors such as the high cost of medical imaging devices and the presence of a large number of suppliers are expected to drive the segment growth during the forecast period. For example, according to an NCBI article published in 2022, the initial procurement cost of Class A medical imaging equipment such as PET/MRI systems exceeds $4 million. MRI systems are a huge investment for healthcare providers because of their often high costs. Because MRI machines come in a variety of sizes and vary in magnetic field strength, costs vary. For example, an MRI system with a magnetic field strength of less than 1.5T sells for about $1.5 million on average. Similarly, high-field (3T) MRI systems cost about $2.50 to $5 million. Medical imaging instruments help build a database of the normal anatomy and physiology of internal organs so that any abnormalities can be detected immediately. Therefore, as the technical complexity increases, so does the total cost of the device. Therefore, the high cost of medical imaging devices is expected to increase market growth. Therefore, the above factors are expected to boost the market growth during the forecast period. In addition, the increase in the number of suppliers is expected to drive the growth of the segment. For example, Summus Medical Solutions, a retail partner of Philips, offers Philips C-arm refurbished medical systems such as BV Pulsera, BV Endura, Philips Veradius and Philips BV Libra. Therefore, the availability of such technologically advanced systems at a cheaper price is expected to drive the market in this segment. Most clinics and hospitals that purchase or use refurbished medical equipment generally have a neutral to positive attitude toward the purchasing experience. Therefore, due to the above factors, the medical imaging segment is expected to get a boost during the forecast period.

Check if the equipment comes with a warranty or guarantee from the seller. Having a warranty can provide you with peace of mind and protection in case the equipment malfunctions or requires repairs. Additionally, inquire about the availability of technical support and maintenance services.